- MORTGAGE

- OUTSOURCING

- DOCUMENT MANAGEMENT

- VIEW POINTTM

Overview

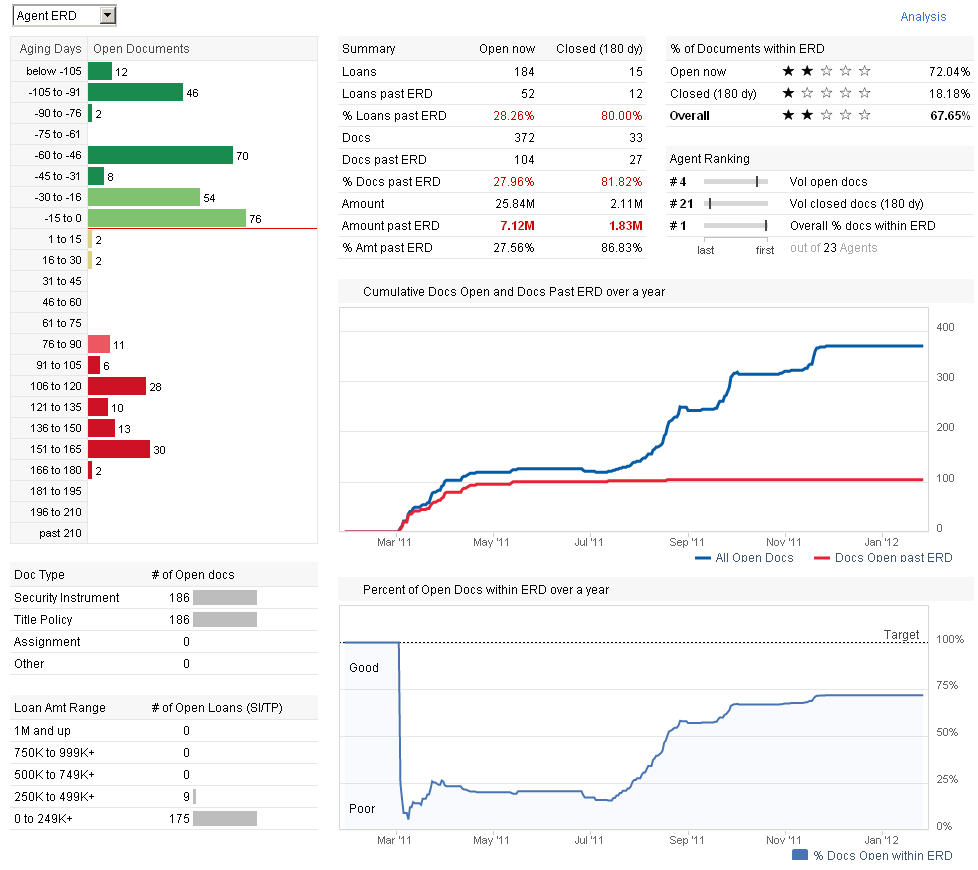

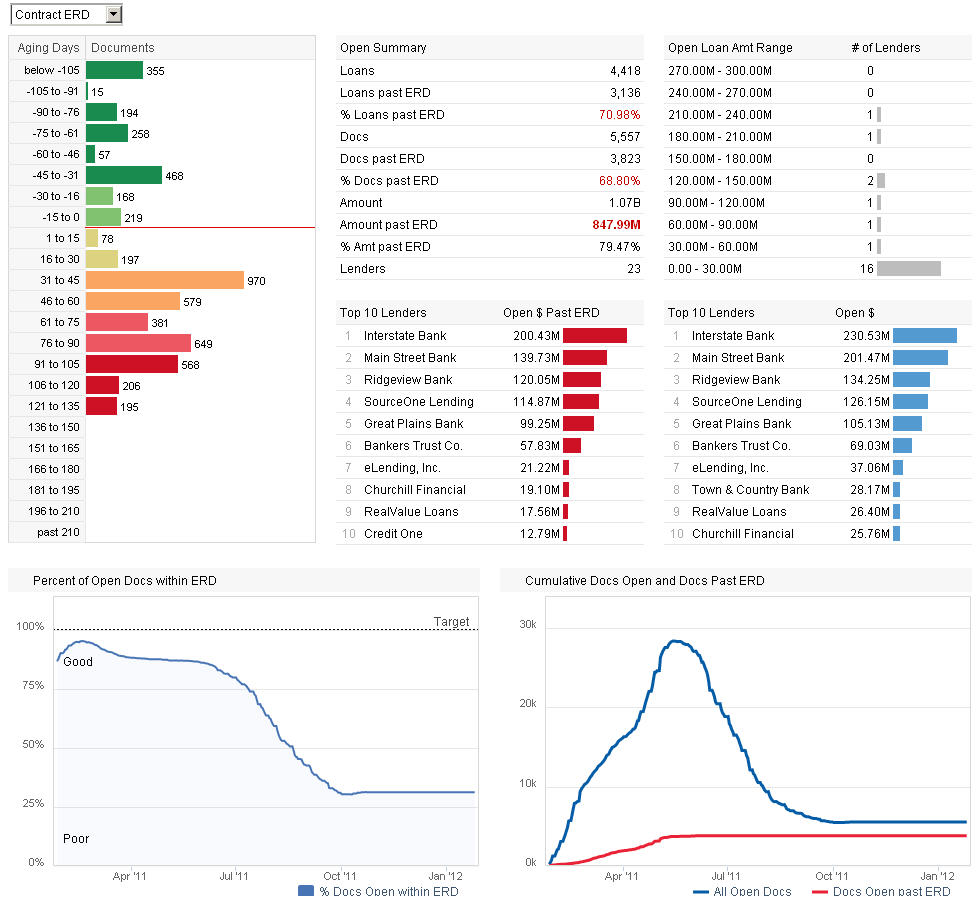

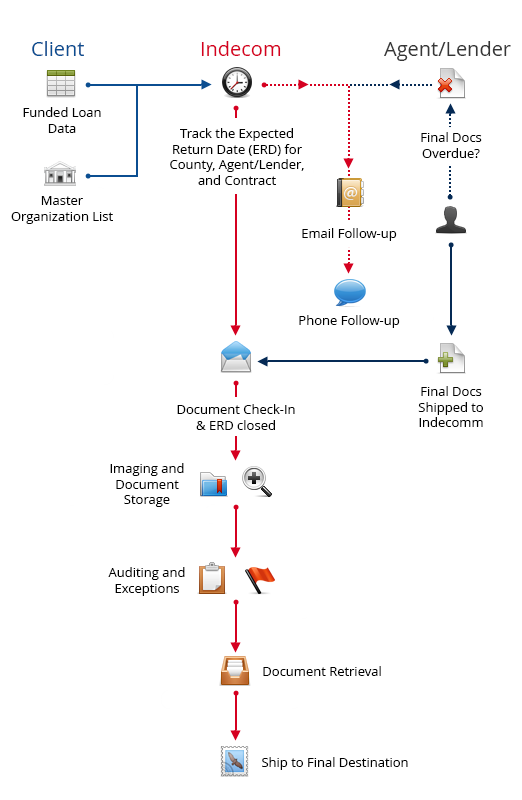

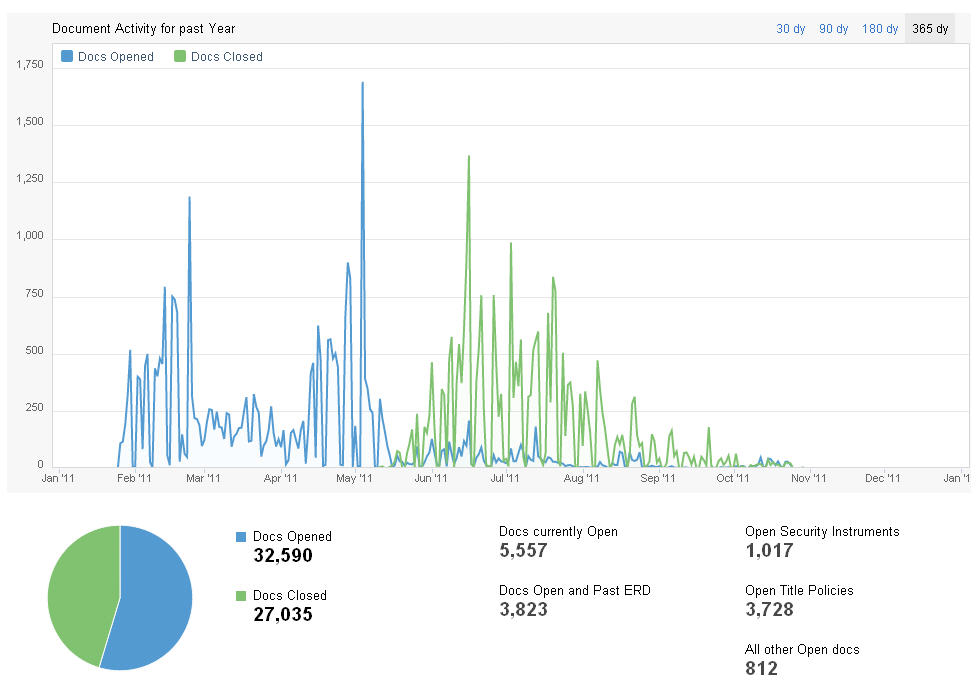

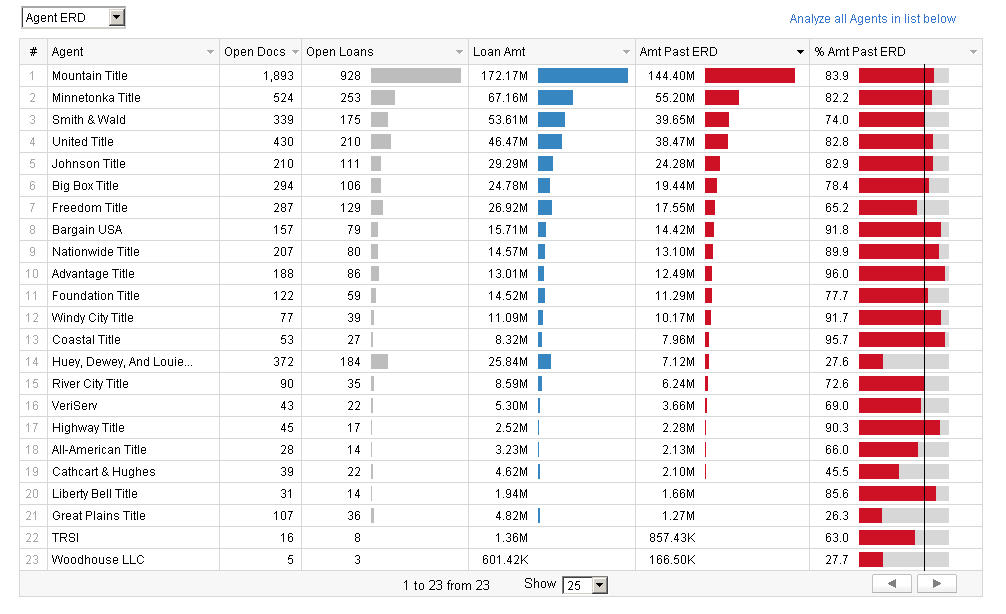

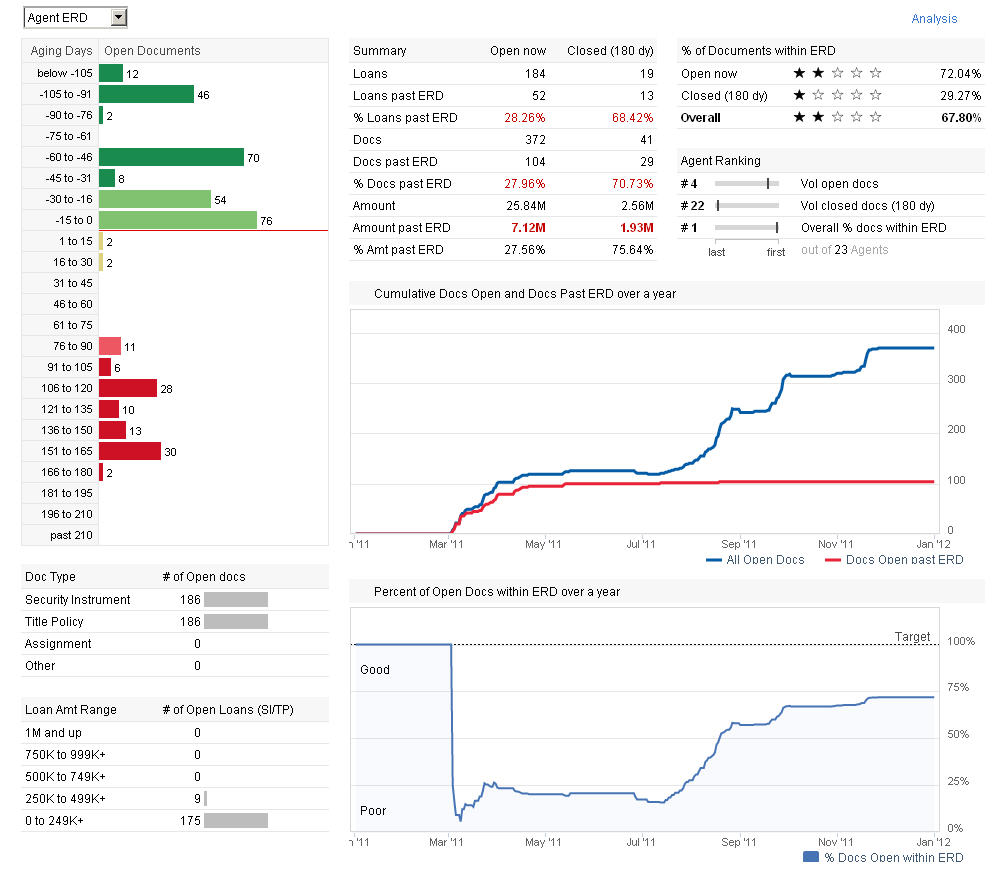

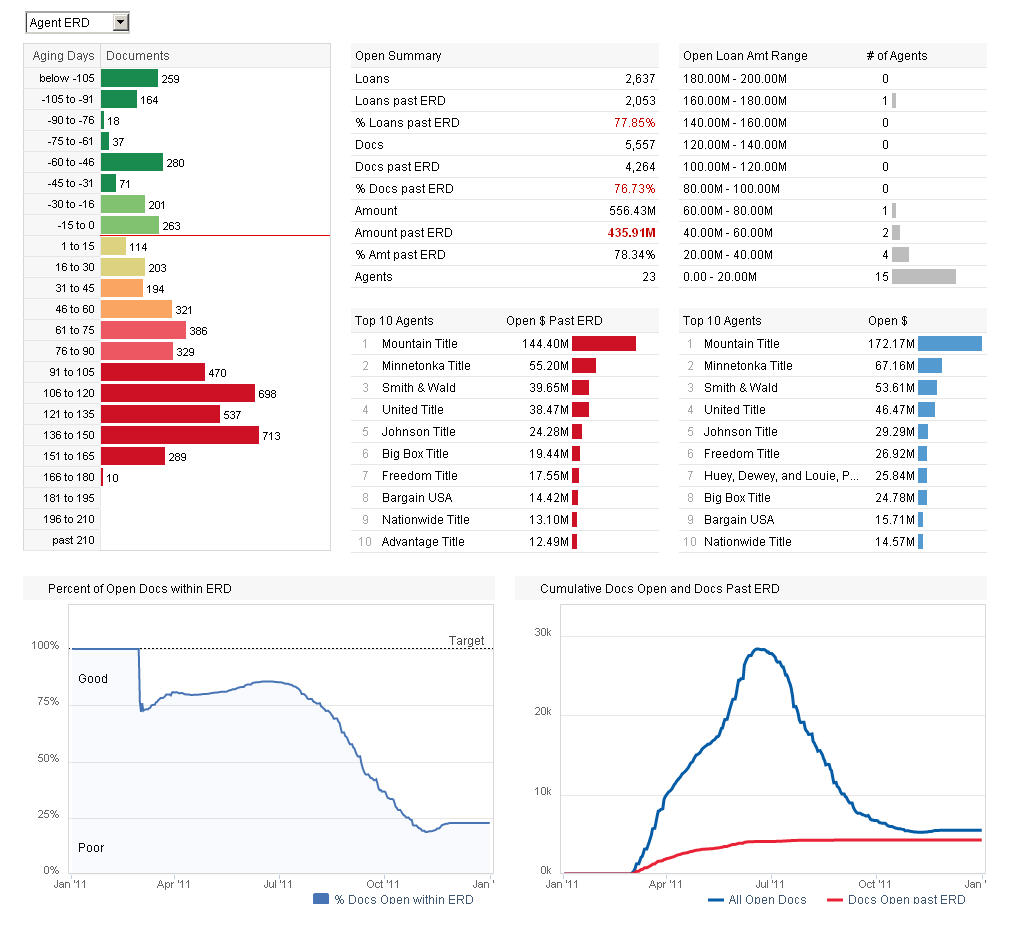

ViewPoint™ is Indecomm’s proprietary technology solution for the management of final documents. Our lender clients send us a data feed as soon as their loans are funded. ViewPoint™ references our extensive data repository that tracks the turnaround times of the counties, and calculates the Expected Return Date (ERD). The ERD is when the lender should expect the mortgage to have been recorded by the settlement agent or their correspondent lender. When the lender receives the final documents pertaining to the specific loan, the receipt is updated in ViewPoint™ and the loan is closed out. ViewPoint™ provides extensive reporting and document tracking capabilities.